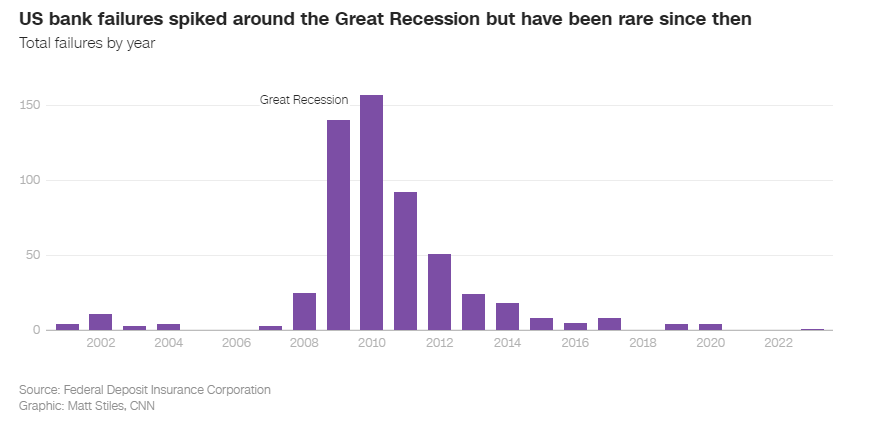

On a Friday morning in March, the news broke that Silicon Valley Bank, one of the most significant tech lenders, had collapsed, marking the second-largest failure of a financial institution in US history. The bank was hit by a bank run and a capital crisis over the past 48 hours, ultimately leading to its downfall.

The Silicon Valley Bank collapse has left many people wondering how this happened, especially since it was a major tech lender. It is the second-largest failure of a financial institution in US history and has left many depositors and creditors without access to their funds.

California regulators closed down the bank, and the US Federal Deposit Insurance Corporation (FDIC) took over as a receiver. The FDIC will liquidate the bank’s assets to pay back its customers, including depositors and creditors. The FDIC stated that all insured depositors will have full access to their insured deposits by no later than Monday morning. The FDIC will also pay uninsured depositors an “advance dividend within the next week.”

The collapse of Silicon Valley Bank started on Wednesday when SVB announced that it had sold securities at a loss and planned to sell $2.25 billion in new shares to shore up its balance sheet. This announcement triggered panic among key venture capital firms, who reportedly advised companies to withdraw their money from the bank.

As a result of the panic, Silicon Valley Bank’s stock plummeted on Thursday, dragging other banks down with it. By Friday morning, SVB’s shares were halted, and the bank had abandoned its efforts to quickly raise capital or find a buyer. Several other bank stocks were temporarily halted on Friday, including First Republic, PacWest Bancorp, and Signature Bank. The FDIC’s takeover of Silicon Valley Bank was notable due to its timing in the mid-morning, as the agency typically waits until the market has closed to intervene.

The decline of Silicon Valley Bank was partly due to the Federal Reserve’s aggressive interest rate hikes over the past year. When interest rates were near zero, banks loaded up on long-dated, seemingly low-risk Treasuries. But as the Fed raises interest rates to fight inflation, the value of those assets has fallen, leaving banks with unrealized losses. Higher rates hit tech especially hard, undercutting the value of tech stocks and making it tough to raise funds, according to Moody’s chief economist Mark Zandi. That prompted many tech firms to draw down the deposits they held at SVB to fund their operations.

“Higher rates have also lowered the value of their treasury and other securities which SVB needed to pay depositors,” Zandi said. “All of this set off the run on their deposits that forced the FDIC to take over SVB.”

The collapse of Silicon Valley Bank has been a wake-up call for the banking industry. It highlights the need for banks to maintain their capital reserves and be prepared for sudden shocks to the system. It is also a reminder of the importance of transparency and communication with customers, especially during times of crisis.

This will have long-lasting effects on the tech industry, which relies heavily on the bank for funding. The collapse of a major lender like SVB could cause a ripple effect across the tech industry, making it harder for companies to raise capital and disrupting the flow of funds to start-ups.

This recent event has raised concerns about the stability of the banking system, but Deputy Treasury Secretary Wally Adeyemo has sought to reassure the public. He said that federal regulators are paying attention to the situation and that the banking system is resilient enough to handle incidents like this.

The collapse of Silicon Valley Bank is a reminder that the banking industry must remain vigilant and be prepared for sudden shocks to the system. It is also a call for greater transparency and communication with customers during times of crisis. As the tech industry continues to grow, the banking industry must adapt to meet the changing needs of its customers.